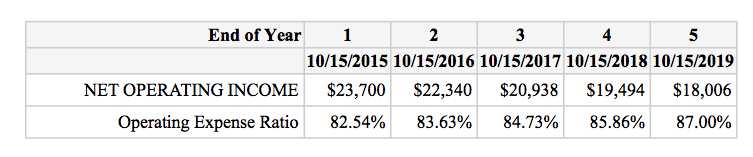

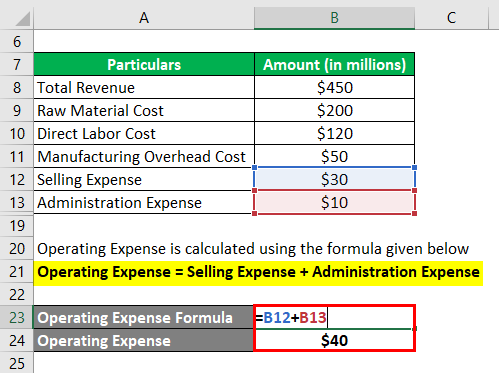

Generally speaking, a rising operating ratio indicates increasing operating costs compared to revenue, and is considered negative.Īccordingly, a falling operating ratio indicates operating expenses are decreasing, revenue and sales are rising, or a mix of the two.Ī company with a rising operating ratio should investigate and determine which cost control measures it needs to implement to optimize its operational efficiency and boost its profit margins. Your team can combine the operational efficiency ratio with other financial KPIs ( key performance indicators, or those financial ratios and metrics used to monitor financial performance and health) such as return on equity, working capital, and return on assets to provide a richer portrait of your company’s overall operational efficiency, and to identify areas in need of further optimization. Uses and Limitations of the Operating Ratio As a metric, it’s used in a similar fashion to the operational efficiency ratio, but applies it to properties rather than businesses.Ī company with a rising operating ratio should investigate and determine which cost control measures it needs to implement to optimize its operational efficiency and boost its profit margins. Whereas the operating efficiency ratio compares expenses with revenue, the operating expense ratio divides a real estate property’s total operating expenses (less depreciation) by its gross operating income. While businesses of all types calculate an operating ratio, the real estate industry has a very similar sounding, but exclusive, financial ratio called the operating expense ratio, unrelated to operating efficiency for businesses. (Operating Expenses + Cost of Goods Sold) ÷ Net Sales = Operating Ratio A Caveat: Operating Expense Ratio vs. The formula used for calculating the operational efficiency ratio/operating ratio is as follows: This becomes important when calculating operational efficiency, as the two must be added together. It’s important to note that while COGS can be recorded as part of operating costs, many companies treat them as separate.

Operating expenses can also include those expenses directly related to production, i.e. Depreciation of fixed assets used outside of production.Sales, general, and administrative (SG&A) expenses.They are variable, frequent, and generally include, but are not limited to: They generally include most of your company’s expenses, barring interest paid and taxes. Operating costs are listed as line items on your company’s income statement. But for the purpose of directly calculating a company’s overall efficiency at minimizing its costs while still bringing in revenue or sales (i.e., calculating the operational efficiency ratio), operating expenses are used. Both CAPEX and OPEX have a direct impact on your company’s financial health. In the course of doing business, your company generates a range of both capital expenses (CAPEX) and operating expenses (OPEX). What is the Operational Efficiency Ratio? By calculating your company’s operational efficiency ratio (also known as the operating ratio), you can effectively measure how well it handles cost management while generating sales or revenue-and make the changes necessary to slash costs and strengthen your company’s financial health and competitive performance. Trimming those expenses while still producing abundant revenue doesn’t have to be hard, however. Even massive revenues can feel like a hollow victory if high expenses are taking a hefty bite out of your bottom line. Competing in the modern global economy takes tenacity, strategic and intelligent planning, and effective methodologies for managing data, business processes, and your company’s overall operational efficiency.

0 kommentar(er)

0 kommentar(er)